Partnering with future thinking firms

Partnering with future thinking firms

Partnering with future thinking firms

Boutique firms trust Photon as their partner for building private financial tools.

Boutique firms trust Photon as their partner for building private financial tools.

Boutique firms trust Photon as their partner for building private financial tools.

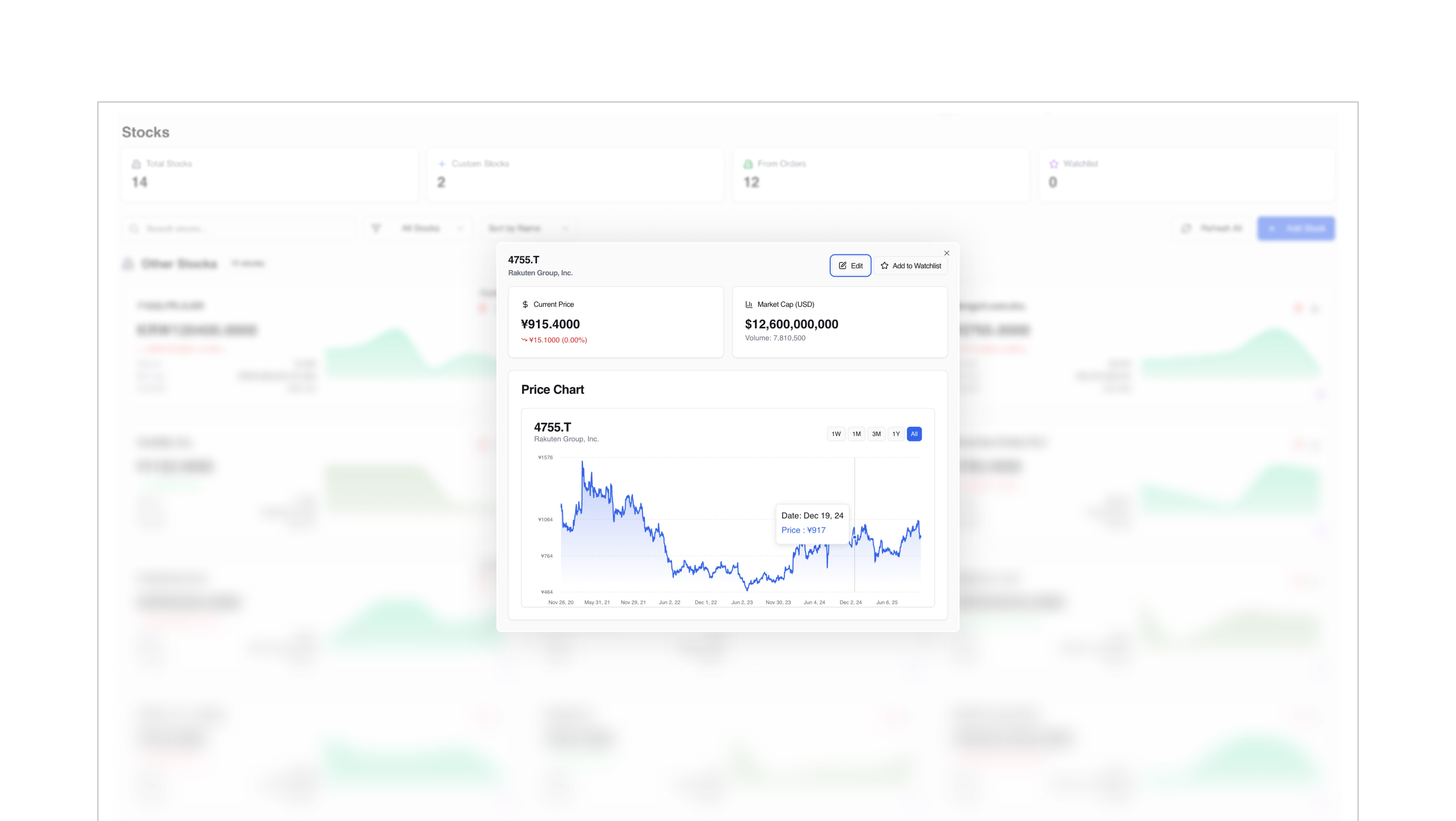

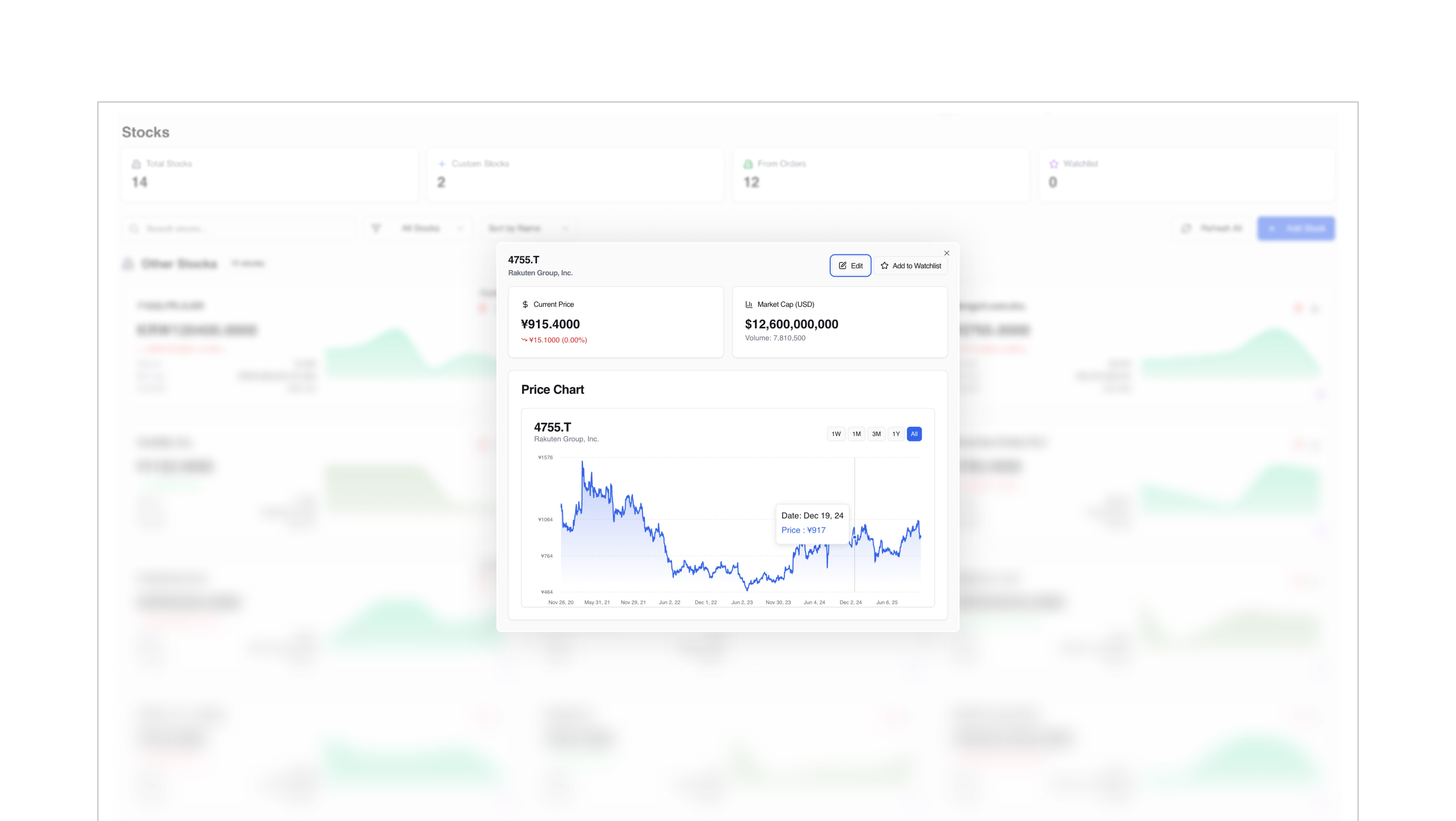

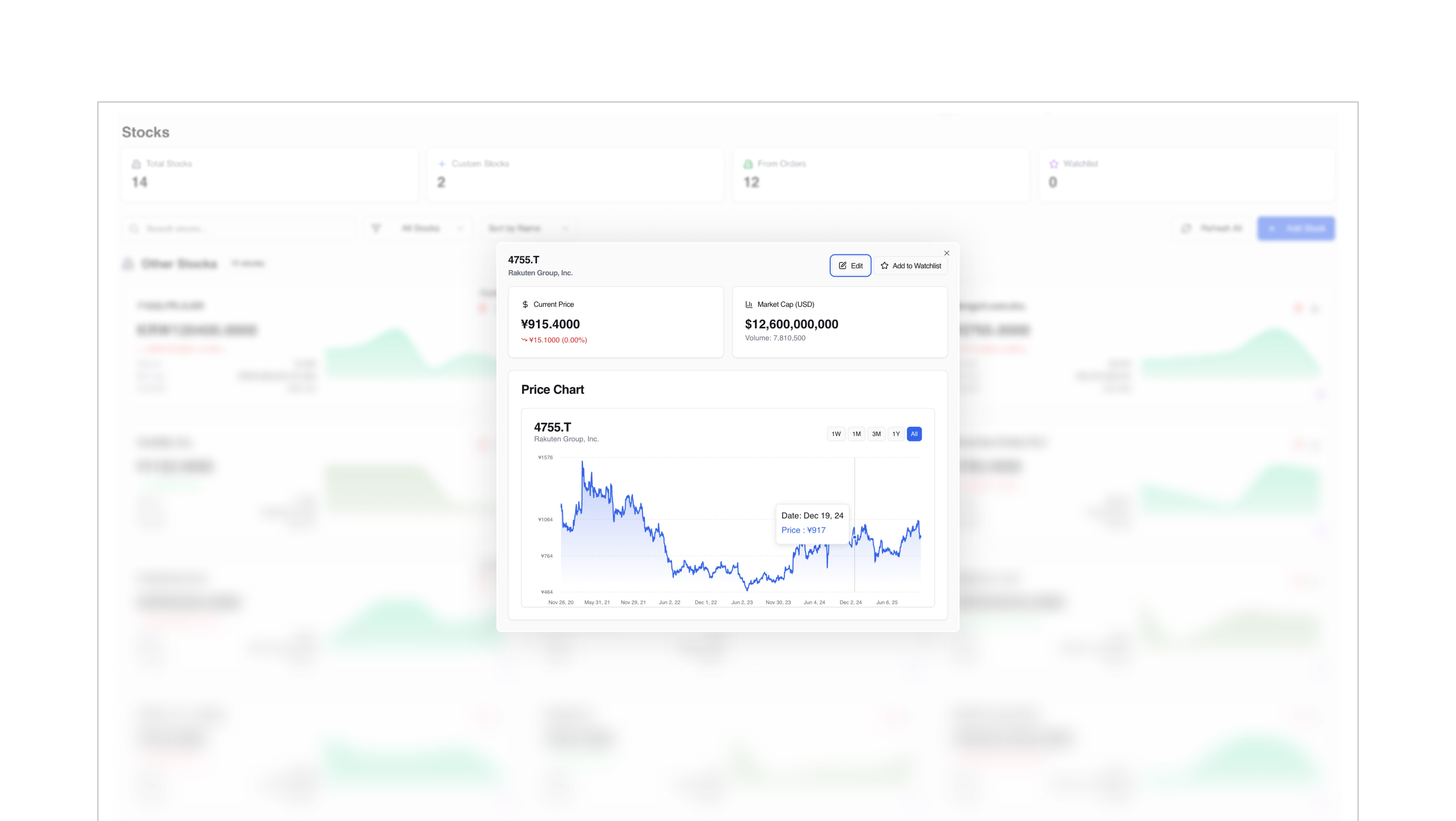

Order Management System

Manages orders and portfolio holdings while seamlessly connecting with custodians and brokers. Provides performance reporting and portfolio insights by integrating with real-time data feeds.

Order Management System

Manages orders and portfolio holdings while seamlessly connecting with custodians and brokers. Provides performance reporting and portfolio insights by integrating with real-time data feeds.

Order Management System

Manages orders and portfolio holdings while seamlessly connecting with custodians and brokers. Provides performance reporting and portfolio insights by integrating with real-time data feeds.

AI-Powered Mortgage Underwriting

An AI system that classifies loan documents, extracts key fields, and flags inconsistencies or issues instantly. Enables underwriters to review extracted values side by side with source PDFs, reducing manual effort by ~40% and lowering error rates by ~50%.

AI-Powered Mortgage Underwriting

An AI system that classifies loan documents, extracts key fields, and flags inconsistencies or issues instantly. Enables underwriters to review extracted values side by side with source PDFs, reducing manual effort by ~40% and lowering error rates by ~50%.

AI-Powered Mortgage Underwriting

An AI system that classifies loan documents, extracts key fields, and flags inconsistencies or issues instantly. Enables underwriters to review extracted values side by side with source PDFs, reducing manual effort by ~40% and lowering error rates by ~50%.

AI-Powered Mortgage Underwriting

An AI system that classifies loan documents, extracts key fields, and flags inconsistencies or issues instantly. Enables underwriters to review extracted values side by side with source PDFs, reducing manual effort by ~40% and lowering error rates by ~50%.

Automated Compliance & Reconciliation

Automatically runs KYC and AML checks against client lists. Reconciles custodian data with internal accounts and flags mismatches, reducing the need for manual reviews.

Automated Compliance & Reconciliation

Automatically runs KYC and AML checks against client lists. Reconciles custodian data with internal accounts and flags mismatches, reducing the need for manual reviews.

Automated Compliance & Reconciliation

Automatically runs KYC and AML checks against client lists. Reconciles custodian data with internal accounts and flags mismatches, reducing the need for manual reviews.

Automated Compliance & Reconciliation

Automatically runs KYC and AML checks against client lists. Reconciles custodian data with internal accounts and flags mismatches, reducing the need for manual reviews.

Global Stock Screening and Analysis

Leverages a proprietary database that aggregates financial data from global sources. Supports filtering by custom metrics—fundamental or technical—and applies machine learning models to detect patterns such as breakouts or double bottoms. Incorporates sentiment analysis from public research reports and SEC filings.

Global Stock Screening and Analysis

Leverages a proprietary database that aggregates financial data from global sources. Supports filtering by custom metrics—fundamental or technical—and applies machine learning models to detect patterns such as breakouts or double bottoms. Incorporates sentiment analysis from public research reports and SEC filings.

Global Stock Screening and Analysis

Leverages a proprietary database that aggregates financial data from global sources. Supports filtering by custom metrics—fundamental or technical—and applies machine learning models to detect patterns such as breakouts or double bottoms. Incorporates sentiment analysis from public research reports and SEC filings.